How Much Will Medicare Cost in 2023

The thing about Medicare is that your premiums and deductibles typically change from year to year. You must be aware of these changes, so no cost differences in the new year come as a surprise. Knowing ahead of time can also be beneficial if you consider making changes to your healthcare plans to see if you can save some money with your out-of-pocket costs.

For example, Medigap plan premiums can change anytime during the year. Let’s say you have a Plan G; you could try to change carriers to lower your monthly premiums. If there is a Medicare plan G saving opportunity, you can bet many beneficiaries will jump at the chance to keep some money in their pocket. Understanding your Medicare costs for the new year is especially important for those on a fixed income.

However, Medicare costs for 2023 are not as cut and dry as we’d like. To give you a general idea of what to expect, let’s look at how much Medicare will cost in 2023.

Original Medicare

Original Medicare is divided into Part A and Part B. Part A will be free for most people as long as they have worked in the U.S. for at least ten years (40 quarters). Everyone pays a premium for Part B that is based on their income. Here are what the Part A and Part B premiums will look like for 2023:

2023 Part A and B Premiums

If you do not qualify for premium-free Part A, you can expect to pay $506/month. If you have more than 30 quarters of work credits but still less than 40, Part A will cost you $278/month.

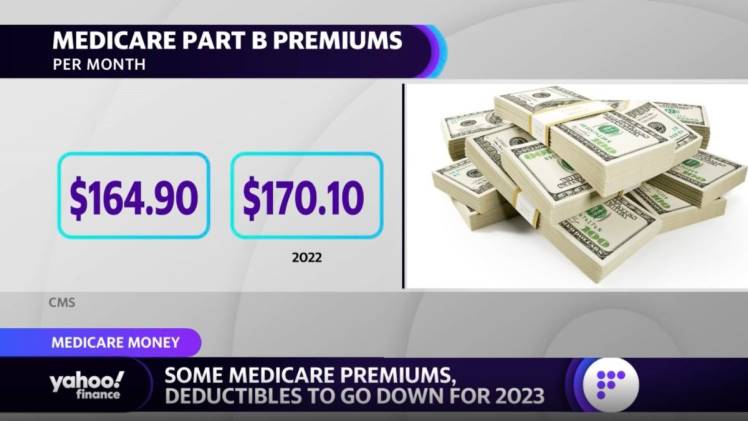

Since Part B is based on your income, you could have to pay more than the standard amount if your income is above a certain level. For 2023, the standard Part B premium is $164.90.

2023 Part A and B Deductibles

Part A has a deductible that you must pay per benefit period. This means you have to pay the deductible if it has been longer than 60 days since an inpatient stay, so you could have to pay this multiple times a year. For 2023, the deductible is $1,600.

Part B has a deductible as well, but this one is annual! Once you satisfy the deductible for the year, Part B will begin paying 80% of the cost of your approved Part B services. In 2023, this deductible will be $226.

Part D

Part D provides beneficiaries with prescription coverage. Like Part B, what you pay for Part D is also based on your income. If you are in a higher income bracket, you will pay more for Part D. If not, you only have to pay the cost of your individual plan’s premium.

Every year in September, your insurance carrier will send out a letter known as an Annual Notice of Change letter. This letter details any changes being made to the coverage and costs under your Part D plan. You can keep your current plan or enroll in a different one that is more suitable for you and will begin on January 1 of the new year.

Deductible

Part D does have a maximum deductible amount. This is the most a plan’s deductible could be, but insurance carriers can choose to lower it. For 2023, the maximum deductible a Part D plan could be is $505.

Medigap

You don’t necessarily have new premium rates at the beginning of the new year with Medigap plans. Since Medigap plans pay secondary to Medicare, these plans will also have rate increases to keep up with the changing Medicare costs and for other reasons, such as inflation.

Most people will have a rate increase around their plan’s anniversary date. Other people can receive an increase around their birthday or even both! So, if your plan anniversary date happens to be around the new year, you can expect a new premium during this time. However, if your plan’s anniversary is in June, you have some time before you start thinking about your plan costs.

Medicare Advantage

Your plan and cost changes will differ if you have a Medicare Advantage plan. Like Part D plans, your carrier must send out their Annual Notice of Change letter every year. Changes to your plan will be noted here. You want to review this carefully to ensure you are okay with the changes.

Review your costs now

Medicare costs tend to change every year, so you want to be sure you are always up to date on what you can expect to pay for the upcoming year and evaluate if your current plan still meets your healthcare needs and budget.