Amazon has leadership positions in key business segments

Amazon (AMZN) is the absolute leader in the segment of online commerce in the U.S. with a share of about 45-50%. The company makes direct sales and also provides its own marketplace and logistics services to third-party suppliers. Also, Amazon is the leading company in the sector of creating infrastructure for cloud computing (IaaS). Amazon shares price and chart interest from many investors and traders.

It owns about 32% of the market. Amazon owns one of the most popular streaming services, which is integrated into the Amazon Prime shared subscription service. It also owns the third-largest online advertising platform. Click here for more updated Vegamovies

Amazon stock price today live is the largest e-commerce platform

The consulting firm Forrester estimates that total U.S. retail sales will reach $5.5 trillion by 2027, of which $1.6 trillion will come from the online segment. Thus, the CAGR of online sales in the next four years will be 10%, and the share of e-commerce in the structure of retail sales from the current 15% will expand to 30%.

By comparison, online retail accounts for about 30% of total retail sales in China today and about 24% in the UK. Amazon does not stop at the U.S. market and is actively investing in the largest emerging economies. Among the most recent steps in this direction is the financing of the business of an Indian airline company specializing in cargo transportation.

By doing so, Amazon will provide itself with additional drivers for business growth and improve cost control in the region. A significant positive factor for developing the segment will be the launch of Buy with Prime (BwP) program in the U.S. on January 31, which opens third-party sellers access to all Amazon services (payments, logistics, etc.) and allows them to trade directly with Amazon Prime subscribers through their sites. Implementing the BwP program will increase the reach of the e-commerce marketplace and add value to Amazon Prime.

The leader in the fast-growing cloud infrastructure market

Amazon Web Services (AWS) has about a third of the cloud IaaS market. Closest competitors Microsoft and Google have about 21 percent and 11 percent of the market. Amazon is increasing the share of servers running on new AWS-developed Graviton3 CPUs (based on the ARM architecture), which are more powerful and provide better performance per dollar cost compared to x86 counterparts from AMD and Intel.

Research And Markets calculates that the global cloud computing market will grow 17.9% annually from 2022 to 2027, reaching $1.24 trillion by the end of that period. Amazon’s key IaaS and PaaS subsegments will see average annual growth rates of 22.5% and 23.4% in that timeframe.

Cost control is a guarantee of Amazon’s live stock price growth

After a strong improvement in all segments of the business during the pandemic, Amazon has launched a major optimization program. We are positive about the company’s steps in this direction and believe in the achievability of the goals set, especially in the direction of online commerce, where the measures taken will make it possible to bring the operating margin out of deficit. bringing it to 5.3% in 2024. In the cloud business segment, the company steadily demonstrates high operating margins (20% or more). This trend will continue to develop due to the increase in computing efficiency and the growth of the average check.

Amazon share price and chart growth in a challenging macroeconomic environment

Amazon’s October-December 2022 revenue rose 8.6% YoY to $149.2 billion, better than management’s forecast (+2-8% YoY) and market expectations (+6% YoY). Excluding the negative impact of foreign exchange (VC), estimated at $5 billion, revenues increased 12.2% YoY. EPS (GAAP) was only $0.03, while FactSet analysts had pegged it at $0.17 on average.

Excluding one-time expenses, EPS was about $0.51. Amazon stock is currently trading at a steep discount to fundamental value and is priced well below historical averages of key multiples. So AMZN live stock prices will continue to rise.

The company maintains leadership positions in its core business segments, is growing in promising new regions, and is implementing large-scale optimization programs. Although this year promises to be a difficult one, we expect Amazon to regain its growth and profitability in 2024 and see significant potential to improve its financial performance in the long term.

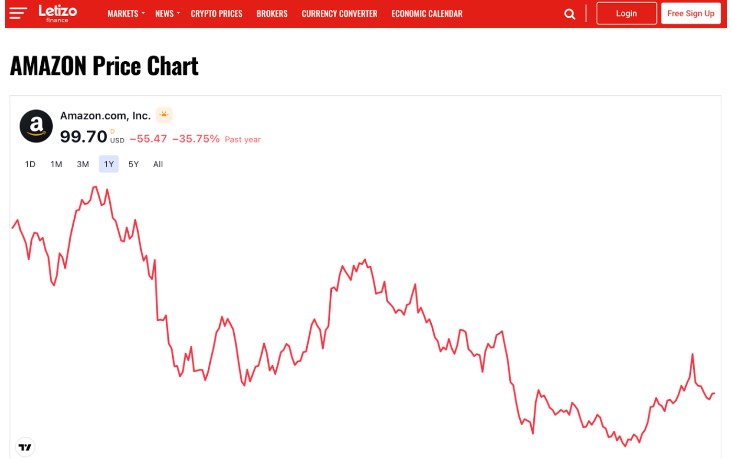

Amazon share price chart history shows positive dynamics. As an alternative, we can consider the AMD live chart. Stay tuned to letizo.com for the latest company news.