Maximizing Efficiency with Payroll Services in Saudi Arabia to Get the Most Out of It

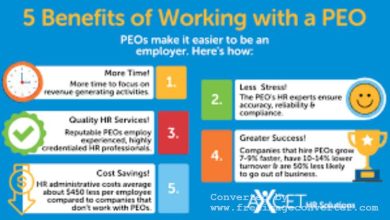

Payroll services can help companies run their operations more effectively and profitably. Businesses can save time and money by automating their payroll procedures and ensuring compliance with local laws with the aid of payroll services.

Additionally, they can assist businesses in streamlining their payroll procedures, improving the employee experience, and lowering the expense of manual processing.

The advantages of payroll services in Saudi Arabia and ways that businesses can maximize their use will be covered in this article.

How to Maximize Efficiency with Payroll Services in Saudi Arabia

A. Identify the Need for Payroll Services

Businesses must determine their demand for payroll services in Saudi Arabia if they want to operate as efficiently as possible. Payroll services can help to simplify procedures, cut expenses, and guarantee adherence to regional legislation.

When deciding whether to outsource payroll services or bring them in-house, businesses should take into account the size of their organization, the number of employees needed, and their budget.

Businesses in Saudi Arabia can take advantage of a variety of payroll services from TASC Corporate Services, including payroll setup, management, and processing, as well as tax compliance.

B. Assess the Current Payroll System

Assessing the present payroll system is crucial after determining the requirement for payroll services. Employers should consider their workforce size, payroll processing frequency, salary calculation accuracy, employee data accuracy, and data security when processing payroll.

Businesses should assess the quality of customer care provided by their current payroll provider and determine whether TASC Corporate Services’ additional services could be advantageous to them.

C. Choose the Right Payroll Service Provider

To maximize efficiency with payroll services in Saudi Arabia, choosing the correct payroll service provider is crucial. The labour laws, regulations, and tax requirements of Saudi Arabia must be carefully considered while choosing a service.

The payroll service provider should additionally be able to offer services in both English and Arabic to make the process simpler for both the company and the employee.

Examining the provider’s customer service and support abilities as well as their security standards is essential to guaranteeing that all data is maintained correctly and securely.

D. Automation of Payroll Services

To maximize efficiency with payroll services in Saudi Arabia, automation of payroll services is a crucial component. Employers can process payroll data, such as wage calculations, deductions, and contributions, promptly and precisely by using automated payroll systems.

Managing employee information and records, such as personal data and contact details, is also made simpler by automation. Aside from lowering the likelihood of human error, automated payroll services can also help decrease the time and expense involved with processing payroll.

The processing of payroll payments can now be done with more flexibility thanks to automation, including using a credit card or direct debit.

E. Ensure the Accuracy of Payroll Data

To maximize efficiency with Saudi Arabian payroll services, accurate payroll data must be guaranteed. Employers are responsible for making sure that all payroll information is accurate and current, and that all taxes and deductions are calculated properly.

Employers should verify the accuracy of the payroll data before processing and transmitting it to the government.

F. Monitor Payroll Services Performance

Employers should monitor the performance of their payroll service provider to ensure that the services are delivered efficiently. Regularly verifying the accuracy of the payroll data would help with this.

Employers will be more efficient if the performance of the payroll services provider is often monitored. This will help them spot possible problems early and fix them.

G. Implement Policies to Improve Efficiency

Organizations ought to put procedures into place to enhance the efficiency of processing payroll. This can include setting up a rigid payment schedule for employees, developing a computerized system to track their hours, and ensuring that all the paperwork is in place.

Thus, operations might become more efficient and payroll administration might take less time.

H. Utilize Technology to Streamline Processes

Another method to increase payroll service efficiency is to use technology to automate procedures. Businesses can spend less time and money while increasing the accuracy and dependability of payroll services by investing in payroll software and automating operations.

With the full array of payroll solutions offered by TASC Corporate Services, businesses can manage their payroll more effectively and customize their payroll procedure.

These options can assist decrease manual errors, increase accuracy, and develop more effective processes. Additionally, by reducing labour costs, paper and printing expenses, and the time spent on manual tasks, these services can aid businesses in cutting back on the costs associated with processing payroll manually.

I. Maintain Compliance with Local Laws and Regulations

For companies doing business in Saudi Arabia, maintaining compliance with local rules and regulations is crucial. Employers who need help fulfilling their legal responsibilities for paying wages, benefits, and deductions can turn to TASC Corporate Services.

J. Invest in Quality Control Measures

To ensure correct and timely payroll processing, quality control procedures should be implemented. This entails carrying out routine audits, establishing employee thresholds and restrictions, and keeping an eye on staff data entry correctness.

Errors will be reduced and local laws will be respected as a result. Additionally, businesses should think about securing payroll services and software with dependable support and upkeep.

K. Develop a Comprehensive Payroll System

For payroll services to be as effective as possible, a complete payroll system is required. It should include capabilities that allow the company to precisely track employee hours, leave days, and other pertinent data.

Additionally, it ought to give managers and other stakeholder’s easy access to real-time visibility into payroll data. Automation ought to be taken into account as well because it can simplify the payroll process and lower manual errors.

Conclusion

To maximize productivity for the best payroll service in Saudi Arabia, TASC Corporate Services offers a complete payroll solution.

With the help of our cutting-edge technology, we guarantee precise calculations and prompt payments, giving you the peace of mind to concentrate on your core business.

Their certified team of specialists will provide you with the necessary guidance and support to ensure that you get the most out of your payroll services and that you can operate your business more successfully and efficiently. Working with TASC Corporate Services may provide you peace of mind that your payroll is being handled by competent personnel.