What is a Credit Score and Reasons Why It Matters the Most?

What is CIBIL score? This is one of the important questions asked by most loan seekers. CIBIL or credit score is the number assigned to you depending upon specific computations. It factors in your credit accounts to decide your credibility or potential to repay your debts by the due date. Credit scores generally range anywhere between 300 and 900 and determine your repayment history, repayment capacity and how good you have been with your credit. A strong credit score of 750 is looked upon as good, and over 750 is considered excellent. Lenders and banking lenders generally consider your score to assess if you can repay your loan.

Additionally, a credit score is extremely necessary for your finances. Based on specific parameters and credit rankings, lenders determine to process your credit application. Thus, such a score influences a lot, and hence it is necessary to understand how you can maintain it. In case you are not careful enough with your score, you can end up repaying a lot in the form of interest rate and processing charges on the loan. On the contrary, having a high credit score may lower your rate of interest and processing charges on credit options. If you are looking to avail a personal loan or any other loan, the minimum CIBIL score for personal loan or other credit options is usually 750 and above.

While the credit scores may impact in various ways, note that there are various other parameters that impact your score and rates also. If you approach a bank today for a loan, then they may turn your request down owing to the low score. To secure a strong credit history, ensure to consider these factors

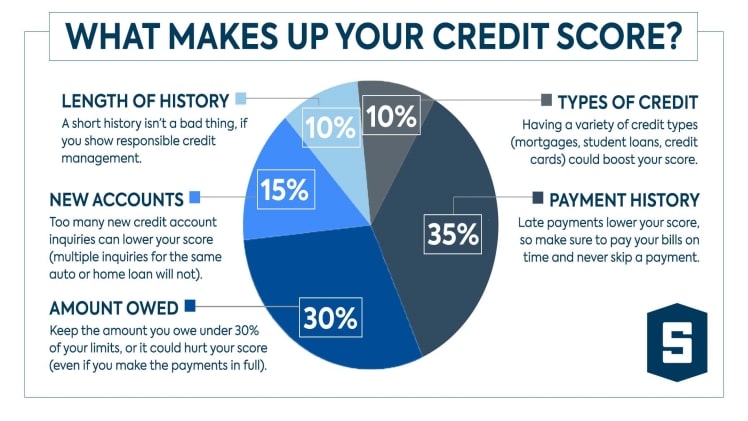

Factors impacting your credit score

A credit score is computed by factoring in specific parameters mentioned in your credit statement. Let’s understand them

Credit utilization ratio

Credit utilization ratio or CUR is the measurement of the balance owed credit card compared to the maximum limit on a credit card. CUR is one of the parameters that impact your score. When your CUR is high, it means you are overspending, which directly impacts your score in a negative manner. How you use your credit is even one of the crucial parameters that are factored in to compute your credit score. In case you do not have any loan or credit card, you will have no credit utilization ratio. In such cases, your score will be zero points for such parameters.

Repayment history

Your repayment history is accounted for in your report, which is utilized to compute your score. It involves the payments done on time and repayment defaulted on or later. Repayment history is considered closely by the lender because it indicates your credibility. If you have made all the repayment before the due date, it shows positively upon your statement and increases your score. On the contrary, any misses or late repayment can get you negative points on your credit score.

Derogatory marks

In case you default on your loan or credit card repayment, it may result in derogatory remarks from the creditor or lender. Such negative info is flagged in your report, which implies to potential lenders or creditors as your default on your repayments earlier, you are incapable of repaying the debt on time. Such negative remarks on your credit report pull down your score considerably.

Average credit history age, overall accounts, and credit inquiries

These are the main factors that impact your credit score. Besides these, there are other parameters too that impact your score. These include your average credit account age, the overall number of accounts, credit mix, number of credit inquiries done by the lender when factoring in your loan or credit card application etc. Those with zero new debts in the immediate past generally tend to hold a higher score than the ones who have currently applied for a new credit account.

Credit score – the importance

In case you still think that a credit score is not very important as it sounds, the listed are the reasons mentioning the importance of a credit score.

Lower and better rate of interest in loans and credit cards

Depending upon the credit score, lending institutions and creditors determine your rate of interest. A higher score implies that you are a reliable applicant and more likely to make the loan and bill repayment by the due date. Thus, creditors and banks generally provide you with the best rates. In this way, a strong credit score may assist you in saving a considerable amount even after availing of a loan or taking up a credit card.

Higher chances of availing approval for credit cards and loans

Your score is what lending institutions, banks and creditors look at the time of processing your credit application. Whether it is a new credit card or a loan, a decent score will permit you to avail approval much faster. However, while the score is not just the only criterion that is considered when placing an application for credit, it is one of the crucial parameters that impact your credit application.

Higher negotiating power

A strong credit score comes in handy as a bargaining chip when you require negotiating the interest rates for a new loan or credit card. A strong credit score is one of the indicators of your credibility and your potential to repay the loan on time. Thus, when negotiating with the lenders, your score brings you appealing offers from distinct lenders, and you will hold the choice to close your loan deal favourably. However, if you hold a low score, lenders or creditors do not conduct any concession on loan tenures, and you usually end up with a higher rate of interest and lower proceeds.

Obtain higher credit card limits

Lending institutions and creditors take an extremely close look at credit score when computing your credit card limit. Individuals with higher scores are most likely to obtain a higher limit on loan as opposed to the ones with poor or average credit score because such score shows their potential to repay on time. Particularly when it is about repaying big loans say a home loan, applicants with strong scores can secure a higher amount as per their requirements.